How do banks prevent identity fraud with facial recognition?

Facial Recognition

Banking

Security Technology

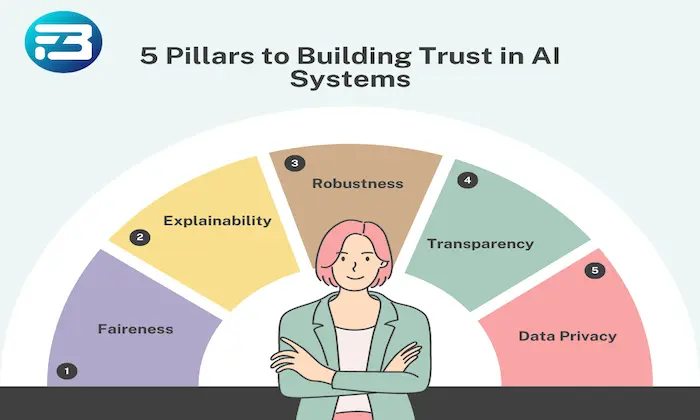

In today’s rapidly evolving digital banking landscape, the challenge of preventing identity fraud has never been more pressing. Banks are increasingly turning to facial recognition technology as a robust tool in their security stack, using advanced algorithms and diverse datasets to protect users and build customer trust.

The Role of Facial Recognition in Modern Banking

Facial recognition is a core component of identity verification in banking, offering fast and accurate user authentication. As digital banking adoption grows, this technology helps prevent unauthorized access, safeguarding customer accounts and strengthening the overall security framework.

How Facial Recognition Systems Operate in Banks

Banks typically deploy facial recognition through a structured verification flow:

Enrollment: New users submit facial images, usually via selfies. These images are converted into unique biometric templates and securely stored within the bank’s system.

Verification: During logins or sensitive transactions, a live facial image is captured and compared against the stored biometric template. Algorithms analyze facial features such as eye spacing and nose structure to confirm identity.

Liveness Detection: To prevent spoofing attempts, banks integrate liveness detection. This includes dynamic actions like blinking or head movements to ensure the presence of a live individual rather than a static image.

Strategic Insights for Effective Implementation

The success of facial recognition in banking depends on disciplined execution across several areas:

Diverse Datasets: Systems must be trained on data covering varied lighting conditions, angles, and occlusions. Datasets such as FutureBeeAI’s facial datasets include diverse expressions and environments, improving real-world accuracy.

Quality Control: Multi-layer quality checks, combining automated validation and manual review, are essential to maintain data integrity and consistent system performance.

Real-Time Monitoring: Continuous behavioral monitoring helps detect anomalies and trigger additional verification steps when suspicious activity is identified.

Avoiding Common Missteps

Facial recognition should not be deployed as a standalone fraud prevention mechanism. It is most effective when combined with multi-factor authentication and transaction behavior analysis. Dataset diversity is especially critical—systems trained on narrow demographics often underperform, reinforcing the need for comprehensive, representative data.

Practical Takeaway

For banks seeking to strengthen identity fraud prevention, facial recognition must be implemented as part of a broader, well-governed security strategy. Leveraging diverse datasets, enforcing rigorous quality control, and monitoring behavior in real time enables banks to reduce fraud risk while increasing customer confidence in digital services.

In summary, facial recognition offers powerful capabilities for banking security, but its effectiveness depends on thoughtful deployment and continuous vigilance. Prioritizing dataset diversity and maintaining strict quality standards are essential to staying ahead of evolving fraud tactics.

What Else Do People Ask?

Related AI Articles

Browse Matching Datasets

Acquiring high-quality AI datasets has never been easier!!!

Get in touch with our AI data expert now!